Have your short- and long-term financial goals changed over the course of 2020? If you are willing to share your story, email money reporter Alicia Adamczyk at alicia.adamczyk@nbcuni.com.

As the coronavirus pandemic upended life in the U.S. and across the world over the past six months, economists have credited the Coronavirus Aid, Relief, and Economic Security, or CARES, Act, with keeping many American families, and the economy at large, afloat.

The record $2 trillion bill provided hundreds of billions of dollars in extra food aid, enhanced unemployment benefits and stimulus checks for workers and their families, including expanding unemployment insurance to millions of workers who previously would not have qualified. It also provided loans to small businesses struggling during lockdown orders and kept some workers on payrolls.

The results: Americans set an all-time-high savings rate in April. And though a record number of Americans were out of work, poverty actually decreased slightly compared to 2019, thanks to the CARES Act's generous safety-net provisions.

In fact, the Federal Reserve reported Friday that "extraordinary governmental measures in response to the pandemic seemed to have eased families' financial strain." Americans' financial well-being was higher in many ways — more adults reported being able to pay all of their bills and pay for an unexpected $400 emergency, among other aspects — in July than it was in April, before the relief efforts from the CARES Act were in place.

"A substantial number of families received one or more forms of financial assistance," including from the government or from a charity, the report reads. "The effects of these programs were apparent in people's overall financial well-being and ability to cover expenses."

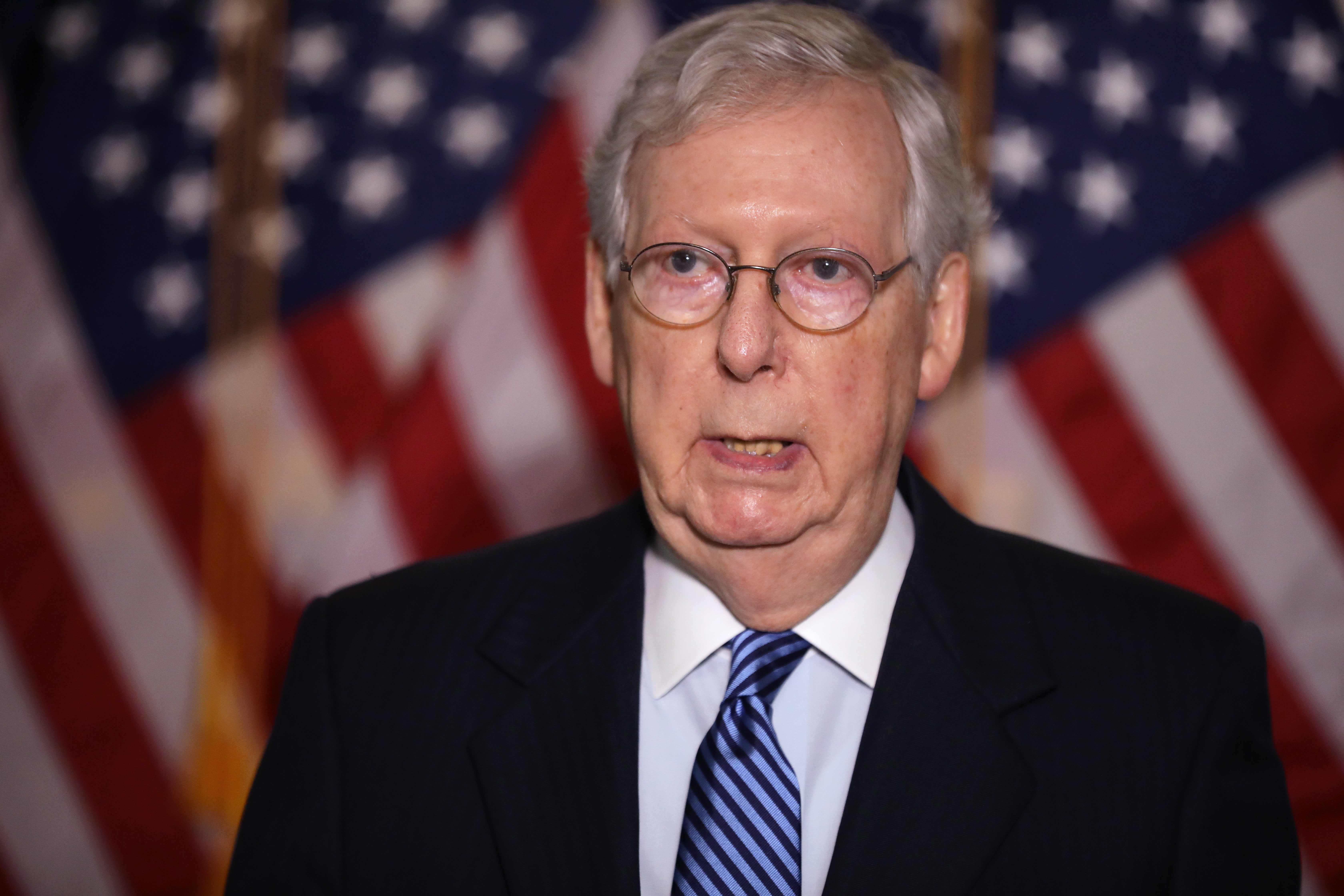

Congress is at an impasse

But many provisions of the law, which was signed by President Donald Trump almost six months ago, have expired or will expire by year's end. At the same time, jobless rates remain high while coronavirus continues unabated in many parts of the U.S.

And Washington is no closer to reaching a deal on another stimulus package than it was at the end of July, when many CARES Act provisions expired. Now, with the death of Supreme Court Justice Ruth Bader Ginsburg and the need to put together a funding bill to keep the government open by the end of September, it looks increasingly unlikely that the Senate will be able to come to a deal any time soon.

That has some economists worried for those who have still been unable to find work, and the larger economy as a whole.

Despite everything else happening, another stimulus deal is at the top of Ronald Starr's mind. The 51-year-old Illinois resident has been out of work for a year, and tells CNBC Make It via email that he finds it troubling that Congress isn't stepping up to help Americans who still cannot find work.

While unemployment figures have improved, in July, 22% of those who had lost their job because of coronavirus said they were still unemployed and they did not expect to return to their old jobs, according to the Fed. Lower-income workers were less likely to have returned to work in the same job.

"With so many millions about to face homelessness possibly, how is this not on the top of the media's headline list," says Starr. "How can Congress take recess? And, speaking of Congress, how is it that there isn't even a dialogue or any discussion going on with this topic?"

There has been a dialogue on Capitol Hill in recent weeks, though it's been a strained one that has yet to yield more aid. Some Republican lawmakers point to falling unemployment numbers as a sign that more stimulus isn't necessary, while Treasury Secretary Steve Mnuchin says a bill providing around $1 trillion in aid makes sense given the current unemployment numbers and the country's budgetary concerns. Earlier this month, Republicans in the Senate failed to pass a "skinny" stimulus bill that provided less than $1 trillion in funding for unemployment benefits and other aid.

Democrats, on the other hand, remain opposed to a "skinny bill," arguing that the $600 per week in enhanced UI benefits should continue through the end of the year, and a new stimulus bill should provide money for housing relief, food, schools and other priorities.

"We can fiscally spend the appropriate amount of money to meet the needs of the American people," House Speaker Nancy Pelosi told CNBC's Jim Cramer last week. "And by the way: It's stimulus. We are a consumer economy and the more we have, whether it's food stamps or unemployment insurance ... that is stimulus to the economy."

Meanwhile, Starr is worried about keeping his lights on as Illinois's utility shutoff moratorium ended. He says he has applied to dozens of jobs, with no luck.

"The work just isn't there," says Starr. "We are stuck, with little to no options and no help on the horizon."

Don't miss:

Check out: Americans spend over $5,000 a year on groceries—save hundreds at supermarkets with these cards

"many" - Google News

September 21, 2020 at 09:23PM

https://ift.tt/35WNefs

'We are stuck, with little to no options': 6 months after the CARES Act passed, many Americans are still struggling - CNBC

"many" - Google News

https://ift.tt/2OYUfnl

https://ift.tt/3f9EULr

No comments:

Post a Comment