Rising inflation expectations are increasing pressure on the U.S. Federal Reserve to take action — specifically, to reduce its purchases of bonds. That would be ill-advised. Instead, the Fed should focus on preventing a potential wage-price spiral.

Inflation expectations play an outsized role in standard monetary theory. Leading economists and economic commentators have repeatedly warned that rising inflation expectations leave the Fed with an unpalatable choice between a rerun of the 1970s and a crushing recession. The latest warning comes from one of the bank’s own former experts, Brian Sack.

More than a decade ago, Sack popularized a measure of inflation expectations that uses market prices to get a sense for where investors think inflation is heading not now, but five years from now. According to Sack, that measure has begun flashing yellow, if not (yet) red.

Sack’s work has often been illuminating. But in this case it doesn’t quite hang together.

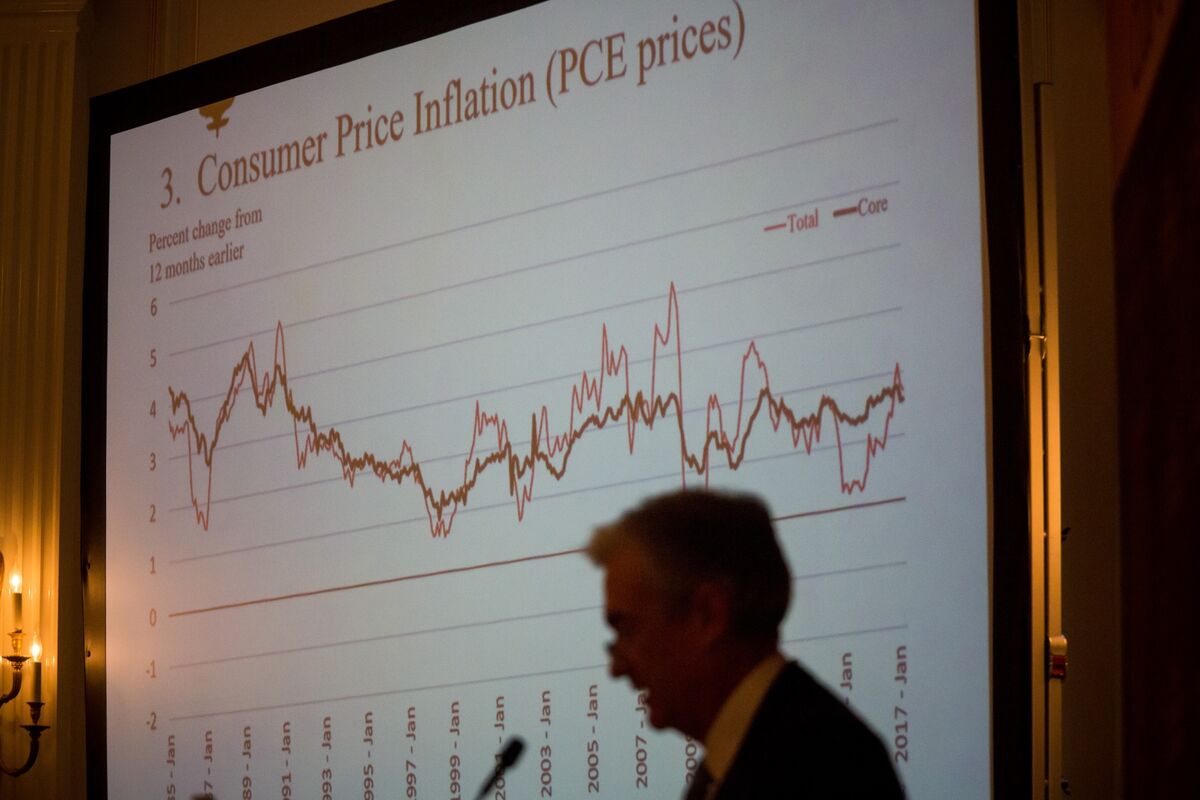

For starters, while the measure is designed to get a feel for what markets think inflation will do in the medium-term future, that future is much more closely aligned with what inflation is doing in the immediate present. In early 2004, for example, Sack’s measure was near the top end of its range and meaningfully higher than it is now: about 2.7% compared to 2.2%. Five years later, core-PCE, the Fed’s preferred measure of inflation, dropped below 1% for the first time in history. It wouldn’t reach 2% for another three years and then for only a few months before sinking below target every single month until 2018.

In fairness, investors could not have foreseen the inflation crash that accompanied the Great Recession. In a way, however, that’s also the point: Both inflation and inflation expectations are driven primarily by current conditions. The high expectations of the mid-2000s did not prevent inflation from falling in response to the financial crisis. Conversely, Sack’s measure hit its lowest value on record in December 2008, when the market was coming apart only to completely rebound one year later.

The crux of the issue is that while economists use the term “inflation expectations,” the actual dynamic is more complex. Consider the concept of pricing norms.

For some goods, like raw commodities, the norms allow wide fluctuations month to month or even day to day. At the other extreme, the price of labor is widely understood only to rise, except in a crisis. These pay increases are most commonly justified as compensation for a higher cost of living. And because wages are the primary cost of production, in the aggregate, rising wages tend to cause rising prices.

This creates the possibility of a self-sustaining wage-price spiral. Employees become accustomed to large wage increases. Those wage increases force large price increases, which in turn justify more rounds of large wage increases. And so on.

That self-fulfilling prophecy is more about the give-and-take in the labor market than fluctuations in the bond market. Unfortunately the U.S. is entering a period where the potential for this type of spiral is real. In April, job openings surged to all-time records, but employment was relatively tepid for this point in a recovery.

There are real restrictions on the labor supply, in particular extra bonuses for the unemployed and irregular school schedules. For now, employers have resisted raising wages because they understand that if they do, it will be very difficult to lower them if they have to.

The tension between these forces will eventually break, however. Either the labor supply will grow, or resistance to raising wages will ease. If the latter happens, the potential for a self-sustaining increase in inflation will be present no matter what the bond market says.

It’s that possibility that should most concern the Fed. There is little that the central bank can do to stop it on its own. But just as Chairman Jerome Powell pleaded with elected officials to do more to support the economy during the peak of the pandemic, he should now encourage them to loosen the supply-side constraints on the economy. Paying for back-to-work bonuses and pushing schools and summer camps to open on schedule will do more to control future inflation than any reduction in bond purchases.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Michael Newman at mnewman43@bloomberg.net

"danger" - Google News

June 09, 2021 at 05:00PM

https://ift.tt/3pEsXmK

Rising Inflation Expectations Are Not Clear and Present Danger - Bloomberg

"danger" - Google News

https://ift.tt/3bVUlF0

https://ift.tt/3f9EULr

No comments:

Post a Comment