The financial circumstances facing millennials has made the average age of the first-time home buyer older, and for some, the situation looks so bleak that homeownership will likely remain out of reach, according to a new study.

In the study published by Legal & General, researchers found that the combined effects of stagnant income growth over the past four decades combined with record-rising home prices are reaching a point where owning a home may not be possible. And with home wealth frequently inherited, the lack of home equity could exacerbate the current wealth gap for future generations.

Legal & General surveyed millennials, generally defined as those born between 1981 and 1996, who currently do not own a home. Only 43% of millennials are current homeowners, making them the generation with the lowest homeownership rate. That percentage is also significantly lower than the overall American average of 65%. Legal & General found the median age of the first-time buyer has risen to 33, up 14% since 1981. Meanwhile, in that same time frame, the average age of all homeowners has jumped from the early 30s to 55, which takes into account both second-home purchases by baby boomers, as well as first-home buyers.

In August, first-time buyers also accounted for only 29% of existing home sales, below the 5-year average of 32%, and the lowest percentage since January 2019, according to the National Association of Realtors.

The underlying problem is income, according to Legal & General, who found that not only are stagnant wages failing to keep pace with home prices compared to previous generations, they can barely keep up with increases in everyday costs for many. In 2019, the Economic Policy Institute determined that the minimum wage was worth 17% less than 10 years earlier and 31% less than what it was in 1968. “If the minimum wage had kept pace with productivity since 1968, minimum wage would be $24 now,” the report said.

Meanwhile, the latest jobs data showed hourly earnings rising 4.6% on a yearly basis, outpaced by inflation, which increased at a consistent, if transitory, 5.4% in September.

But even when companies increase their wages, “it is still doubtful that it would constitute a broad enough change to bring younger workers in line with the galloping cost of housing,” according to the report. Over half — 52% — of Legal & General’s respondents were not saving for a down payment.

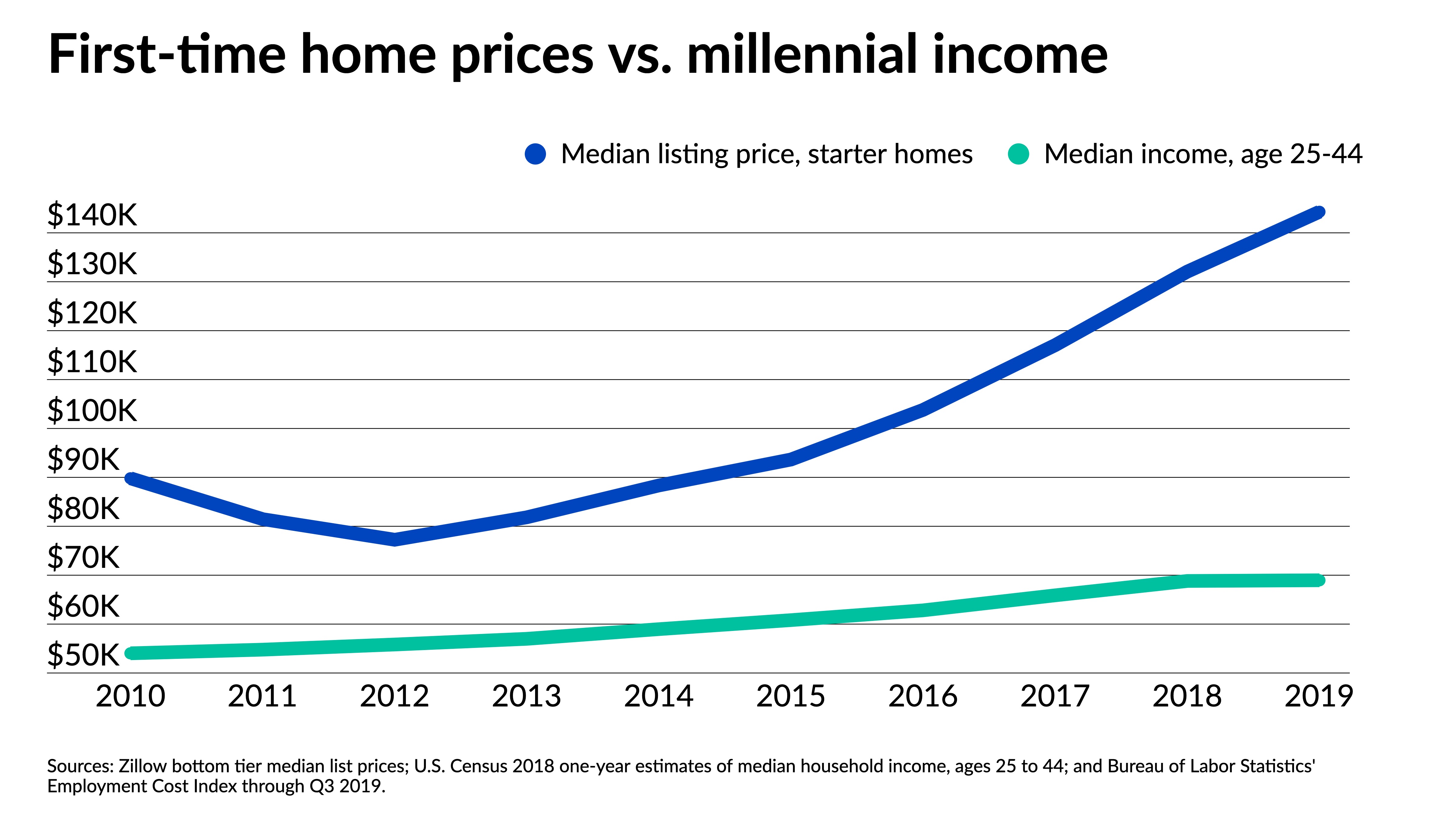

While average millennial income has increased 24% since 2012, housing prices have taken off, increasing by 86% in that same time frame. Nor are the recent housing increases restricted to specific markets or home types. The median price of a starter home in 2019 in the U.S. was $215,000, a 15% increase from one year earlier, according to the National Association of Realtors.

Using the generally accepted baseline that no more than 30% of income is spent on housing and basic living expenses, the average millennial could qualify for a home in the range of $220,000, provided they could afford a down payment. The U.S. Census Bureau reported the average millennial salary as $47,034 in March 2020, while 80% of Legal & General’s respondents said they currently earn less than $60,000 annually. But among that share, almost half of millennials older than 30 were living on less than $50,000 a year, with that number falling to 30% for those between 25 and 29.

“Looking at the overall picture, it would be hard to make the argument that millennials, at least those responding to our survey, are making a living wage — which, as of 2020, was calculated at $68,808 a year. Across our three sub-groups, those who could possibly afford to buy a house — we’re conservatively estimating that at salaries of $50,000 or above — is only 47%,” the report said.

There are few signs of home price growth slowing dramatically in the near term. In July, the CoreLogic Case-Shiller index pointed to a 19.7% yearly increase in property values, which was preceded by an 18.7% rise a month earlier.

“Even back in the day when, like the Californias, Floridas, Arizonas, Texas were experiencing high price appreciation, the Midwest would kind of trot along at two or three or 4% price appreciation year over year,” said Dale Baker, president of home lending at Key Bank.

“But this time around, price appreciation has come to the Midwest also. And when you look at markets like Cleveland, for example, you're seeing double-digit price appreciation, which is not typical. So it would seem that prices are up everywhere.”

While the average age of the first-time home buyer has gone up, prices have not been the only cause. Many millennials have waited longer before pursuing major life choices compared to previous generations.

“Millennials have delayed key lifestyle decisions in favor of investing in the pursuit of education, pushing marriage and family formation to their early-to-mid 30s. Previous generations made these lifestyle choices in their 20s,” wrote Odeta Kushi, deputy chief economist at First American Financial Corp., in a blog post. “Marriage and family formation are two of the most powerful motivations for homeownership, so these delayed lifestyle choices tend to also delay the desire for homeownership.”

Education improves the prospects of owning a home, though, according to First American’s Homeownership Progress Index, which found the difference in the homeownership rate between college-degree holders and those with a high-school diploma at 6.9%, almost double what it was in 2000.

At the same time, the price of education may also turn out to be a setback to homeownership goals for the millennial demographic. About 14.8 million millennials carry student-loan debt, averaging almost $39,000 per borrower — more than any other generation. That hampers their ability to save for a home. And while rents have not increased as dramatically as home prices, they still outpace inflation on an annual basis.

Tackling home affordability is key toward narrowing the wealth gap, according to the Legal & General report. While the Biden administration introduced proposals to address the issue, obstacles remain to keep current disparities from continuing beyond the millennial generation. Many millennials that researchers spoke to are waiting for family inheritances to become homeowners, while some still lived with their parents.

“Homeownership is normally passed on from parents to children, and is considered a primary source of wealth generation. With the current trend that more and more people are unable to afford homes, how will this affect the wealth gap for future generations?” the report asked.

"many" - Google News

October 25, 2021 at 10:35PM

https://ift.tt/3pBLVMx

Wage disparities make homeownership elusive for many millennials - National Mortgage News

"many" - Google News

https://ift.tt/2OYUfnl

https://ift.tt/3f9EULr

No comments:

Post a Comment